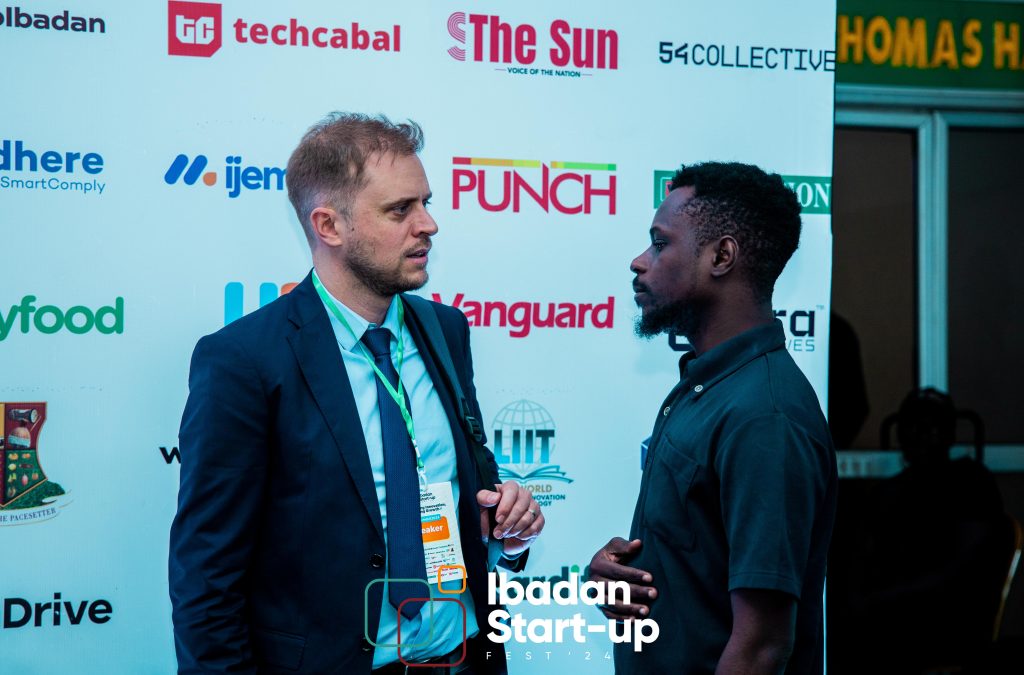

MicroFintech: Driving Financial Innovation for Inclusive Growth

Founder

Charles Belanger is an internationally recognized expert in financial inclusion, fintech strategy, MSME lending, and agricultural finance. With a deep understanding of emerging markets, he partners with DFIs, development agencies, banks, and fintech startups to design scalable and sustainable digital financial solutions.

With two decades of experience across 40 countries in Africa, Asia, the Middle East, and Latin America, Charles has led high-impact projects in digital credit, embedded finance, climate-smart lending, and fintech innovation. His work bridges the gap between technology, financial institutions, and underserved communities, ensuring that inclusive finance models are commercially viable and impactful.

He has collaborated with institutions such as the International Finance Corporation (IFC), IFAD, FAO, private actors like Equity Bank and Vodacom MPESA, and regional fintech leaders, advising on product design, digital transformation, and market entry strategies. He is pursuing a Doctorate in Business Administration (DBA) about the experimentation of innovations for financial inclusion.

Experiences

Fintech Strategy & Digital Lending for MSMEs

🔹 Client: A regional bank expanding its digital credit products for SMEs

🔹 Region: East Africa & Southeast Asia

🔹 Solution: Developed a digital MSME lending strategy, integrating AI-powered credit scoring and alternative data models to enhance financial access for underserved businesses.

🔹 Impact: Increased MSME loan approvals by 35%, reducing credit decision time from 10 days to 24 hours.

Agri-Finance Innovation & Climate-Smart Lending

🔹 Client: A multilateral DFI investing in agricultural finance solutions

🔹 Region: West Africa & Latin America

🔹 Solution: Designed a climate-smart credit framework using satellite data and IoT to assess creditworthiness and manage risk for smallholder farmers.

🔹 Impact: Enabled 250,000+ farmers to access finance, unlocking $200M in funding for climate-resilient agriculture.

Embedded Finance & Digital Payments for Financial Inclusion

🔹 Client: A fintech scaling embedded finance solutions for last-mile payments

🔹 Region: Middle East & North Africa (MENA)

🔹 Solution: Designed a B2B2C embedded finance model that integrates mobile wallets, digital credit, and insurance into everyday transactions.

🔹 Impact: Increased digital payment adoption by 40%, reaching 5M+ users in underserved markets.

Fintech solutions

Let’s Collaborate!

Looking for expert insights into fintech strategy, MSME lending, or inclusive finance models? Let’s build scalable, impactful solutions together.

Ask for a tailored offer

Contact: charles.belanger@microfintech-solutions.org

Financial Institutions

- Telcos and Fintechs: Vodacom MPESA, Orange Money, eprod, PVeRS, PCES, Juakali, SOWIT, RetailPay

- Banks: Fidelity Bank, FCMB Bank, Equity Bank, Rawbank, Bank of Africa

- Microfinances: Baobab, FINCA, First Microfinance Bank, Juhudi Kilimo Kenya, Musoni, MicroLoan Foundation, Oxus, Padecom, Vision Fund, Coopec SIFA, RCMEC, UNACOOPEC, SUMAC

Contact

- Email: charles.belanger@microfintech-solutions.org

- Phone number: +254-740868652